BUSINESS OWNER

As a Business Owner you face a unique range of issues. Business owners are often so involved in managing and running their businesses that planning your own future takes a back seat. We think that personal financial planning is vital for business owners although we do recognise that your personal finances can be closely linked to your business. The new pensions legislation gives you opportunities for tax relieved profit extraction through pensions. It can also allow for business premises to be purchased or for loans back to your business in certain circumstances.

You may also face issues connected to your business:

• What happens in the event that one of your partners or shareholders dies or is disabled?

• Do you have a partnership or shareholder agreement?

• Is that agreement written in such a way as to ensure that Business Property Relief is retained?

• Are you able to repay business loans?

• Could you withstand the loss of a key employee?

Johnston Financial has been working with business owners since 1988 to plan their future and insure the security of their businesses. We would welcome the chance to work with you.

HOW WE CAN HELP YOU

PERSONAL PENSION PLANNING

Personal pensions are essentially a way of saving for later life with tax benefits. Those benefits include tax relief on the contributions, tax free investment and accumulation during your working life and the ability to take one-quarter of your pension pot as a tax free lump sum.

It is no longer necessary to buy an annuity with the remainder of your pension pot, instead you can leave it invested and draw down from it as much or as little as you wish. On your death, any unused pot can be passed on to your spouse or partner to draw on and can even be left to your children or grandchildren free of Inheritance Tax.

There are limits to what can be contributed and accumulated and there are tax implications of drawing money out of the plan. Johnston Financial can help you to make the best use of the generous pension system. Click here for more detailed information.

PURCHASING COMMERCIAL PROPERTY THROUGH A PENSION PLAN

Using either a Self Invested Personal Pension Plan (SIPP) or a Small Self-Administered Pension Scheme (SSAS) to purchase a commercial property either as an investment or for your business to occupy can have tax advantages as assets inside a pension plan are exempt from capital gains tax and corporation tax. The money in your pension plan can be the means of purchasing the property and your pension plan can borrow to help with the purchase. Property is only one of a range of specialist investments that can be held in a pension plan and Johnston Financial provide a service to advise you. Click here for more detailed information.

TAX EFFICIENT PROFIT EXTRACTION

The recent changes to dividend taxation and the new pension freedoms means that taking a wider view of how profit can be extracted from a business can help to reduce tax. Johnston Financial can work with you to create a strategy to match your circumstances.

PROTECTING YOUR FAMILY AGAINST YOUR DEATH OR DISABILITY

Accurately assessing what your family would have and what your family would need, to live on in the event of your death or disability is time well spent. It is hard to contemplate such a catastrophe affecting yourself, but sensible planning will ensure that if the worst happens, your family do not suffer financial hardship.

BUSINESS LOAN REPAYMENT IN THE EVENT OR YOUR DEATH OR DISABILITY

Outstanding business loans can reduce the value of a business and if that is part of your family’s financial protection, having insurance to repay the loans on death and or critical illness is sensible planning. Many lenders make it a condition of the loan that it is covered with life assurance. Johnston Financial can provide you with competitive rates from across the entire insurance market.

CREATING A STRATEGY FOR BUSINESS SUCCESSION ON DEATH OR DISABILITY OF A SHAREHOLDER

Johnston Financial are regularly asked to advise on Business Succession. We start by discussing with you, what you as shareholders wish to happen to your shares on death of one of you. Frequently, the intention is that the remaining shareholders will buy the shares from the deceased shareholder’s personal representatives. This requires an agreement between the shareholders that will not invalidate Business Property Relief against Inheritance Tax. The next step is to put a policy in place that will pay out the money to allow the shares to be purchased. Click here for more detailed information.

PROTECTING THE BUSINESS AGAINST THE DEATH OR DISABILITY OF A KEY EMPLOYEE OR PRINCIPAL

Does your business have a key individual whose loss could affect the profitability of your business and possibly even its survival. This is where keyman insurance has a place. The key person can be insured against death, critical illness or long term disability or any combination of those. Johnston Financial can advise you on how to protect your business.

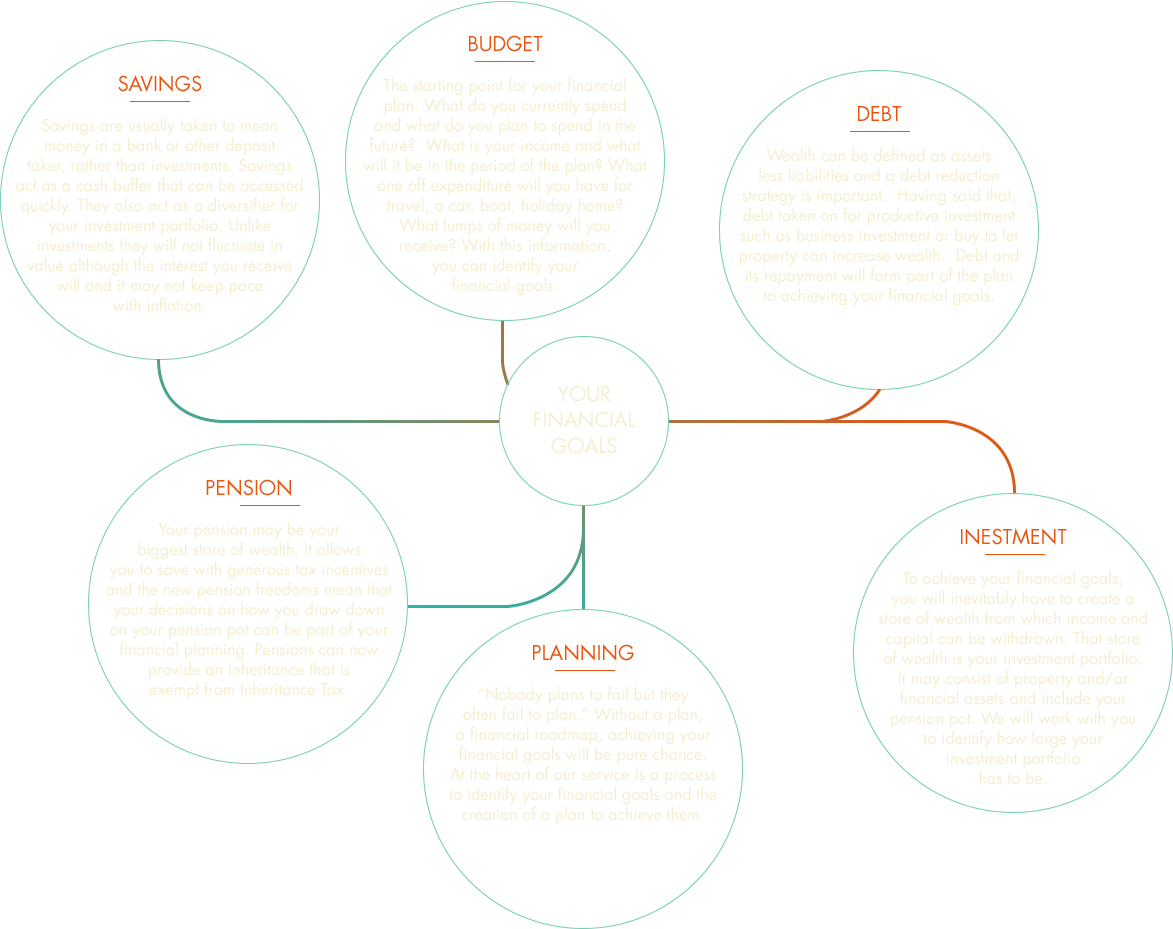

ACHIEVING YOUR FINANCIAL GOALS